Local 201 Important Updates for Members

FLEETLOGIX WORKERS OVERWHELMINGLY VOTE TO JOIN 201

Updates

FLEETLOGIX WORKERS OVERWHELMINGLY VOTE TO JOIN 201

FLEETLOGIX WORKERS OVERWHELMINGLY VOTE TO JOIN 201

FLEETLOGIX WORKERS VOTE TO UNIONIZE - 3/21/24

Avis Budget Holiday Swap Vote - 12/14/23

Grind Agreement Ratified 🗹 - 11/21/23

Local 201 Holiday Events - You're Invited ❄❅❄

Local 201 General Election Official Results

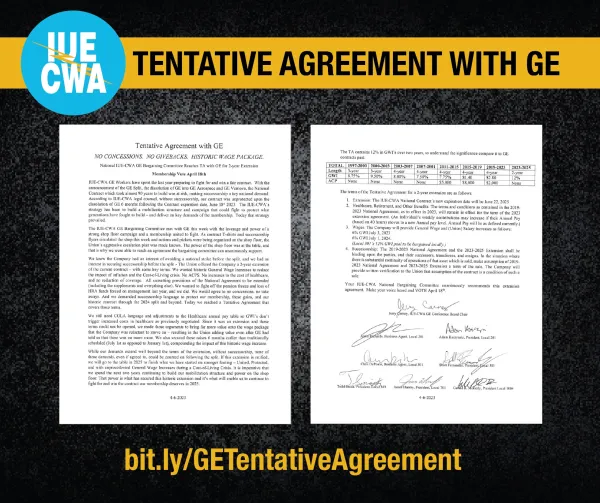

National IUE-CWA GE Bargaining Committee Reaches TA with GE for 2-year Contract Extension

Read it HERE.

CLICK TO SIGN UP FOR 201 Email Updates